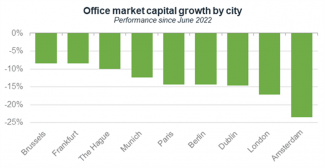

25th September 2023, London - The trajectory of capital values in London’s office sector is further ahead than almost every counterpart market in Europe, according to MSCI data analysed by BNP Paribas Real Estate, with capital growth for London’s office sector declining by 17.1% year-on-year (Q2 2022 – Q2 2023).

Further analysis of the data for office market capital growth over the same period across eight additional key markets – Amsterdam, Berlin, Dublin, Hamburg, Frankfurt, Milan, Paris, and The Hague – revealed the office sector in the UK capital had corrected the most since June 2022, with the exception of Amsterdam.

Source: BNP Paribas Real Estate analysis of MSCI index data, dated 05.09.2023.

With tentative signs that interest rates may peak by year-end, this indicates that London’s commercial real estate sector is in the final stages of absorbing a price correction which began at the start of Q2 2022, following softer market conditions prompted by higher inflation, the rising cost of debt and tightening monetary policy. BNP Paribas Real Estate suggests London will likely be the market to lead a recovery in investment momentum in coming year, and investors focused on the medium-term outlook should be cautiously preparing for a turning point on the horizon.

Fergus Keane, head of central London investment markets at BNP Paribas Real Estate commented: “The London office sector is offering a very rare entry point for investors for either repriced core product, or those with the means to spend capex to reposition assets into the core market. For a decade, it’s been a seller’s market, and that’s now flipped, with buyers holding the upper hand, particularly if you’re an all equity player. There are some convincing positive aspects emerging for investors able to adopt a longer term view. However, this entry point won’t last long. Analysis of previous downturns shows yields can come in quickly when interest rates start to fall, and this is expected to come through in the first half of 2024. I expect this window of opportunity will be closing this time next year.”

A cheap pound is already attracting overseas investors. Q2 saw European investment into Central London offices is on the rise, accountable for over 21% of total volumes, an increase of 18% in comparison to their equivalent share in H1 2022. While Asia Pacific investors continue to feature strongly, with 42% of all Central London office investment during the first half of the year accounted for by APAC-based purchasers.

There are further underlying indicators which support the trajectory that office capital values in London are further ahead than Europe, and also at the bottom of a repricing cycle:

- London office capital growth has underperformed most European gateway markets since 2019

- Office investment volume remains subdued, with £1.3bn transacting during Q2, a reduction of 49% year-on-year. This saw H1 2023 turnover reach £4.77bn, a downturn of 40% year on year.

- Prime office yields continue to move higher. In the City market, prime yields increased by upwards of 50 bps in Q2 to c. 5.25% - a 13-year high. The West End moved 15bps to 4% over the same period.

- Price discovering is emerging through some key market sales, including:

-

- 135 Shaftesbury Avenue, WC2

- 55 St. James Street, SW1

- Lotus Portfolio

- 20 Old Bailey, EC4

- Cargo, 25 North Colonnade, E14

- 1 Poultry, EC1

Fergus added: “Some buyers and sellers are tempted to compare this market with the conditions we saw back in 2008, but today is fundamentally different. It actually shares more characteristics with 2011/12 on the “real estate cycle clock”. While debt has become more expensive, it remains available, and there is a lot more dry powder waiting to be deployed today. There is also much less distress in the market, and assets are coming to the market selectively. Lastly, the market is coming off a 10-year cycle of low supply, while occupier demand for the very best modern buildings remains competitive and this will continue to drive selective rental growth.

These are compelling indicators for what’s about to come. Equity investors need to be serious to secure opportunities, examining opportunities now and early into the new year in order to be ready to take advantage of other buyers being forced to wait on the sidelines due to the high cost of finance. Market sentiment suggests yields could drift a little further by year end which I expect might represent the peak.”