Social value is becoming an essential aspect of real estate ownership and development as demand for sustainable finance-related social investments grows.

By Katie Kowalski, Social Value Lead

The European Union is developing an EU Social Taxonomy aimed at leveraging financial markets to support sustainable and socially inclusive economic growth across Europe. Meanwhile, the UK Government has introduced legislation that requires social value to be evaluated as part of the tender process when outsourcing all contracts over £100,000.

Real estate investments are increasingly no longer assessed purely on financial performance, but with wider social and sustainable considerations that measure the impact of a building on its local community, its occupiers, and the environment.

“To ensure you’re maximising social value you really need to take a tailored approach,” says Katie. “It’s about much more than doing a bit of volunteering - it’s about digging deeper into what your community really needs and how you can deliver that in tandem with your own goals."

What are the legal requirements for social value (current and likely)

| Region | Current | Likely |

|---|

| England & Wales | The Public Services (Social Value) Act requires businesses and organisations which commission public services to assess and evaluate how they can achieve social, environmental and economic benefits. | This regulation will likely be integrated into private sector contracts too as interest in social impact from investors increases. |

|---|

| Wales | The Well-being of Future Generations (Wales) Act sets out seven well-being goals for all local and national governments and other public bodies to consider. | As these goals are advocated as best practice they are likely to be integrated into private sector policy in the future. |

|---|

| Scotland | The Procurement Reform (Scotland) Act states that the well-being of a local authority’s area must be considered by all contracting authorities. | Current Scottish government discourse on the Fourth Sector and Social Return on Investment methodologies indicates an interest in mainstreaming social value policy and introducing it to the private sector. |

|---|

| Europe | The EU Platform on Sustainable Finance proposed a structure for a ‘Social Taxonomy’, in February 2022 to sit within the current European legislation on Sustain- able Finance and Governance. | It is expected that the UK will follow suit with its own variation of a social taxonomy, as with the proposed ‘UK Green Taxonomy’ framework, which largely replicates the ‘EU Taxonomy’ and sustainable finance disclosure regulations in Europe. |

|---|

There are four key steps to establishing social value options for a project or property” explains Katie. The process begins by identifying who the relevant key stakeholders are in your supply chain, your local community, and the people who use and benefit from your space. “Once this is in place you will have the foundation to embed social, economic, and environmental value into every layer”, she adds.

Developing an asset specific social value framework and implementation strategy to ensure you maximise the value of assets and your ESG credentials is also critical when looking to realise the full potential and value of an asset. "For example, if you are delivering a new development this would include ensuring it aligns with local plans, incorporating social value measures at the planning application stage, and implementing monitoring measures throughout the lifestyle of the development. Whereas a social value framework to support occupiers might include mentoring programmes, mental health provisions,

and local charity partners.”

- IDENTIFY STAKEHOLDERS such as the local community, occupiers, workforce, supply chain producers

- MAP THE NEEDS of those stakeholders, such as community and employee social spaces or fundraising

- CREATE a set of target outcomes

- DEVELOP A STRATEGY and reporting framework to achieve and publicise those outcomes

How to quantify social value

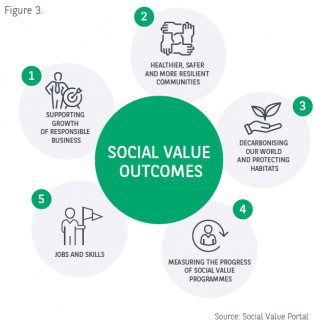

There are several ways to quantify social value, the most popular of which is to use a tool to assign proxy financial values to social value outcomes, particularly around the local economy, access to services, employment, health and wellbeing, access to nature and biodiversity improvements.

Some of these tools work best for the public sector, where strict adherence to the UK TOMS (themes, outcomes, and measures framework) is needed, whereas others offer a wider-ranging, more flexible approach taking into account, for example, natural capital projects. Katie explains that “after identifying stakeholder needs, BNP Paribas Real Estate works with clients to determine the best tool to help them measure and quantify their relevant impacts."

Social value in practice: 245 Hammersmith Road

At 245 Hammersmith Road, a 330,000 square foot office development, owners Legal & General (LGIM Real Assets) and Mitsubishi Estate London commissioned BNP Paribas Real Estate to quantify the social value of the building using Social Value Portal.

Originally built to re-imagine the workplace, inspire and connect people, 245 Hammersmith Road opened its doors in 2019. The building has since delivered a new standard of office space with unparalleled amenities for, and engagement with, its occupiers and the local community.

Our property management team embedded social value in the contract procurement process and ensured all contractors were aligned with the TOMs framework. The team has also completed various activities from providing haircuts for the homeless to offering space to host local social groups and implementing social initiatives, including over 200 hours supporting people into work, 107 weeks of apprenticeships, work experience and training opportunities, and 199 hours

of improving staff wellbeing.

The project created more than £20 million of social value in the first three years of the building’s operational phase, equating to 410% of social value added per pound of contract value. In recognition of its success, 245 Hammersmith Road was awarded the Social Value Innovation Project Award in 2021 - a testament to the how BNP Paribas Real Estate created a ‘socially aware’ mixed-used scheme, with social value embedded into all decision making.

How improving social value can benefit your business

“We all know that delivering social value is a good thing in terms of improving people’s lives and communities, however, less is known about the financial benefits it brings too. Developments planned with community in mind can have a higher gross development value and a new build premium that is eroded more slowly. Office assets that deliver social value well (see 245 Hammersmith Road case study for an example) can see better occupier engagement and relationships, a healthier, happier work environment, fewer occupier change overs and fewer void periods, leading to higher rental values and ultimately higher capital values”, says Katie.

- Increase value and create a commercial edge

- Boosting local community connections

- Attractiveness to occupiers: rental yields increase by 16-25% On ESG aligned assets

- Good marketing opportunities

- Increasing recruitment and employee retention

- Contribution to society: 10-20% of marks allocated for social value in public sector bids

- Potential of gaining planning consent: £15bn of potential additional value to unlock if social value and UK planning system are integrated

- Increasing footfall: 22% increase in interest from investors in real estate assets with ESG credentials

- Improving employee satisfaction and wellbeing: 75% of workers want their employers to make a positive contribution to society*

Sources: UKGBC, GRESB Research, Social Value Portal, Deepki Research, European Union Platform on Sustainable Finance, ILL Research

* PwC's Global Workforce Hopes and Fears Survey, 2022