The ascent of ‘Alternative’ real estate assets such as healthcare, hotels, student housing and the private-rented sector in recent years is extensively documented. UK Institutions continue to increase allocations, under the belief that current demographic and lifestyle trends support further rental growth in these sectors.

The shift to Alternatives has been rapid. As recently as 2007, the Office and Retail sectors accounted for 80% of the capital value of the MSCI UK Annual Index. By 2017, this share had fallen to 65%. The suggestion that this percentage has further to fall is one of the few predictions that can be put forward with a reasonable amount of conviction. There is certainly no shortage of present-day evidence, and theory, suggesting that structural change in the office and retail sectors will continue to challenge performance.

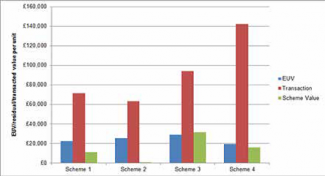

As Figure 1 shows, the contrast between the new, rising stars of real estate investment and the old workhorses could not be starker. In the 12-months to Q1 2018, the Standard Industrial sector saw a 21% total return with Distribution Warehouses at 17%, Hotels at 14% and Healthcare at 12%. Conversely, Shopping centres and Retail Warehouses saw returns of 1% and 7% respectively, while Standard Offices saw a total return of 8%.

Figure 1 – Total Returns 12 months to Q1 2018

Source: MSCI IPD UK Quarterly Index Q1 2018

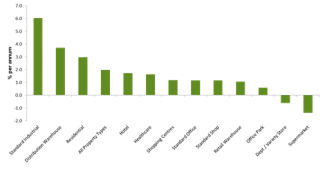

As ever, it pays to look beyond the headline returns. In Figure 2 we examine the same sectors, but looking just at rental growth.

One thing is clear: strong total returns in Alternative sectors are in part justified by their underlying market rental value growth and not driven entirely by yield compression. Interestingly, the much-maligned Shopping Centre segment actually saw the best outturn in terms of rental value growth among the retail segments, despite being the worst performing among them at a total return level.

Of course, strong yield compression reflects expectations of future rental growth. And it is here that uncertainty lies. At a generalised level there are strong arguments favouring rental growth. The industrial sector is likely to continue to benefit from the incremental shift towards online shopping, and the increased productivity engendered by automation, while residential rents have proven to be less cyclical in nature than in the commercial sector as population growth and centripetal forces continue to support pricing in urban and suburban areas. Hotels continue to do well on the back of rising tourism, and the healthcare sector has the certainty of an ageing population to support it.

Figure 2 – Market rental value growth 12 months to Q1 2018

Source: MSCI UK Quarterly Index Q1 2018

However, a note of caution: the performance of these new shining stars in the real estate universe has been underpinned by a few factors outside the ones mentioned:

- First, it is important to consider the indirect effect that the implementation of Quantitative Easing programmes across most developed economies has had on increasing demand for real estate assets globally. A below average risk-free rate coupled with muted returns on fixed-income assets has in turn lowered target returns required by investors in real estate,

- Second, we must be cognisant of the fact that the Alternative sectors – Hotels, Care Homes and PRS – can often offer greater availability of long lease, RPI-linked real estate investment opportunities. Often these assets can carry an attractive yield gap over traditional sectors,

- Third, the prolonged uncertainty stemming from the outcome of the June 2016 EU-Referendum has weighed on the performance of the Offices and Retail. That said, total returns for the City Offices and West End Retail segments recorded three-year annual average total returns to Q1 2016 of 17.7% and 19.6% respectively.

This series of conditions has helped the industrial and alternative sectors to outperform their peers thus far.

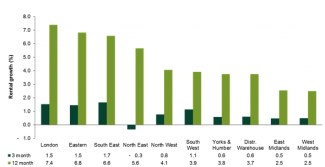

If we look more closely at the wider industrial sector’s rental trends from MSCI IPD UK Quarterly Index Q1 2018, both the Standard Industrial and the Distribution Warehouse’s time series witnessed their strongest annualised rental growth to Q1 since the series begun in 2001, 5.3% and 3.7% respectively.

While the strong occupier demand for distribution warehouse assets has been widely documented, Figure 3 indicates a buoyant Standard Industrial’s rental growth.

Figure 3 – Standard Industrial market rental value growth by region to Q1 2018

Source: MSCI IPD UK Quarterly Index Q1 2018

To conclude, the UK commercial real estate landscape is changing and investors are adapting to a new frame of reference. Those investors who are able to see beyond high level numbers to capitalise on asset-specific opportunities will have a greater chance to outperform industry benchmarks. Hence, analysing micro-level demographics trends and the presence of robust multi-modal infrastructure links have the potential to enhance total returns in these emerging sectors.